The Risk Ceiling

Every transition ends where the underwriter’s model begins

Welcome back to The Ledger - a weekly briefing of what’s happening inside complex systems around industrial decarbonisation. Welcome to Issue #13.

THE OPENING ENTRY

Decarbonisation doesn’t fail for lack of technology. It fails for lack of insurability.

A chemicals plant in the North East of England. The engineering team has spent 18 months designing a waste-heat-to-hydrogen system. ROI: 4 years. Carbon savings: 2,400 tonnes annually. Board approval: unanimous.

The insurance broker’s email arrives on a Tuesday: “Unable to provide coverage for experimental technology.”

Experimental? The system uses electrolysers from 1920s designs. The heat recovery is standard. The hydrogen handling has 60 years of precedent.

“But not in this configuration,” the broker explains. “Our models don’t have a category for it.”

The project dies. Not because it won’t work. Not because it’s uneconomic. But because Lloyd’s of London doesn’t have a spreadsheet cell for it.

This is happening everywhere. The energy transition isn’t failing in boardrooms or on balance sheets. It’s dying in insurance offices, killed by risk models that haven’t been updated since Thatcher was Prime Minister.

The veto moved from the boardroom to the underwriter’s spreadsheet.

FIELD REPORTS

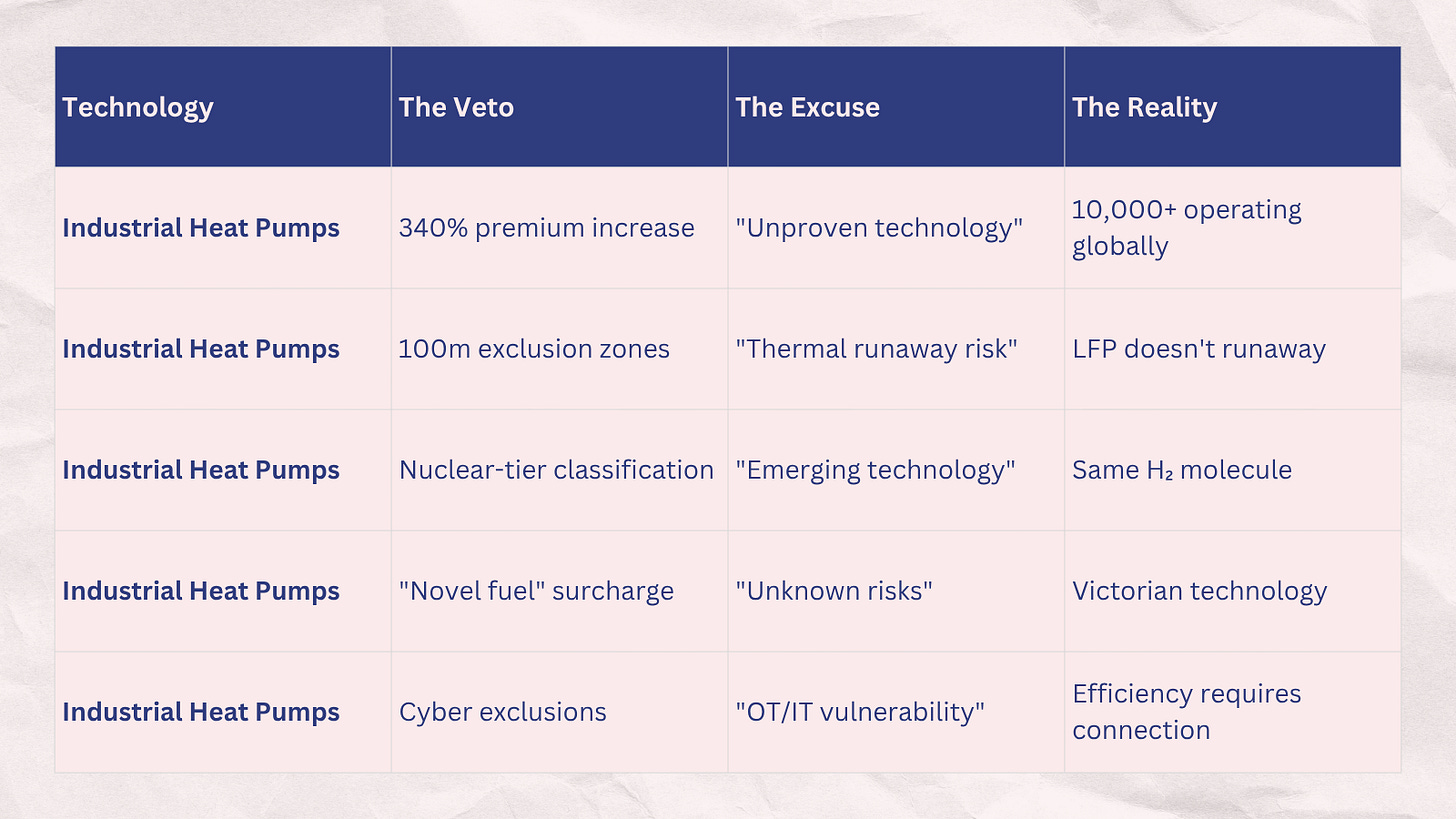

1. The Heat Pump Hostage

Food manufacturer, Northern England. Installing a 2MW industrial heat pump. Technology proven since 1980s. Over 10,000 installations globally.

Insurance position: “Unproven technology surcharge - 340% premium increase.”

Their existing gas boiler? Built in 1973. Exploded twice. Grandfathered into standard coverage.

“We insure what we understand,” the underwriter says. “We understand gas boilers.” “Even ones that explode?” “Especially ones that explode. We have data on explosions.”

The heat pump would save £180,000 annually. The insurance premium increase: £195,000.

The FD’s calculation is simple: “We’re being charged more to be safer.”

Different plant, same pattern.

2. The Battery Blockade

Distribution centre, Midlands. Plans for 5MWh battery storage. Would provide grid services, backup power, and energy arbitrage. Pays back in 6 years.

Insurance requirement: 100-metre exclusion zone around the battery.

The site is 90 metres wide.

“It’s the thermal runaway risk,” the risk assessor explains. “Modern LFP batteries don’t have thermal runaway.” “Our model doesn’t differentiate battery chemistries.”

2011: The last time their model was updated. Lithium iron phosphate has been standard since 2019. The insurance industry still treats them like Nokia phone batteries.

Project abandoned. They install diesel generators instead. Higher fire risk, grandfathered coverage.

New technology, same veto.

3. The Biomass Burial

Paper mill, Scotland. Switching from gas to biomass boilers. Same technology Victorian mills used. Insurance classification: “Novel fuel source.”

Premium impact: £450,000 annually.

But here’s the absurdity: they already burn biomass. Black liquor from the pulping process. Have done for decades.

“That’s different,” insists the underwriter. “It’s the same boiler. Same combustion.” “Different spreadsheet column.”

The sustainability manager laughs bitterly: “We can burn our own trees, but not someone else’s trees.”

Progress, priced out by precedent.

4. The Hydrogen Hypocrisy

Steel plant, England. Proposing green hydrogen injection to reduce coal use. 15% blend, minimal modifications needed.

Insurance verdict: Requires COMAH upper tier classification. Same category as nuclear sites.

Meanwhile, the coking plant next door handles 50,000 tonnes of hydrogen annually. Standard industrial coverage.

“What’s the difference?” “Grey hydrogen is traditional. Green hydrogen is emerging technology.” “It’s the same molecule.” “Different risk profile.”

The plant engineer summarises: “We’re penalised for our hydrogen being clean.”

Innovation, isolated from reality.

5. The Software Squeeze

Every modern efficiency project involves software. AI optimisation. Digital twins. Predictive maintenance.

Insurance position: Cyber exclusion clauses.

Manufacturing company, Yorkshire. Their new energy management system could save 20% on consumption. But connecting it to production systems voids their cyber insurance.

Run it isolated? Loses 80% of the benefit.

“Any OT/IT integration triggers exclusions,” the broker explains.

The CDO is blunt: “Insurance has made Industry 4.0 uninsurable.”

THE ACTUARIAL OUROBOROS

Here’s how insurance mathematics kills innovation:

Year 1-20: New technology = no data = “unquantifiable risk” = prohibitive premium Year 20-40: Some data = “emerging technology” = high surcharge

Year 40+: Proven technology = standard coverage = obsolete by then

Innovation is trapped in a feedback loop: no data, no coverage; no coverage, no deployment; no deployment, no data. A perfect actuarial ouroboros - the snake eating its own tail.

By the time insurance accepts a technology, there’s a better one they won’t insure.

The head of innovation at a major manufacturer explained: “Every technology has a 40-year insurance lag. Solar panels got normal coverage in 2020 - for 1980s panels nobody makes anymore.”

THE GRANDFATHER PARADOX

The most dangerous equipment in any plant has the best insurance terms. Why? Grandfathering.

That ammonia system from 1962 that’s killed three people? Covered. The modern replacement with failsafes? Experimental.

“Insurance rewards age, not safety,” a plant manager tells me. “Every year we don’t upgrade, our premiums get better.”

One risk assessor admitted: “A 50-year-old boiler we understand. A new heat pump terrifies us. We’d rather insure predictable catastrophe than unpredictable improvement.”

THE LONDON CEILING

Every major industrial insurance decision flows through London. A handful of syndicates at Lloyd’s effectively decide what technology the world can use.

“Twenty people in EC3 are determining global industrial policy,” one broker confides. “They’ve never left the City, but they’re deciding if a plant in Malaysia can install solar panels.”

Every solar panel, every electrolyser, every factory retrofit passes through a five-street radius in the City of London.

The concentration is absurd:

5 syndicates control 60% of industrial coverage

3 actuarial models determine all risk pricing

1 market’s paranoia shapes global industry

A renewables developer summarised: “We’re not fighting physics or economics. We’re fighting the imagination of underwriters who think wind turbines are experimental despite 300,000 operating globally.”

WHAT THE LEDGER REVEALS

The insurance industry has become the de facto regulator of industrial decarbonisation. Not through climate risk assessment - through technology incomprehension.

Their power is absolute:

No insurance = no finance

No finance = no project

No project = no transition

But their knowledge is fossilised:

Risk models based on 1980s industry

Categories that predate renewable energy

Actuaries who’ve never seen modern technology

Spreadsheets that can’t compute innovation

The bitter irony? Climate change is the insurance industry’s biggest threat. But their risk models are preventing the solutions.

One broker told me privately: “We know we’re the bottleneck. But updating our models would mean admitting we’ve been wrong about risk for decades.”

BREAKING THE CEILING

Tactics for surviving the veto structure.

For manufacturers:

Get quotes before design. Insurance will kill your project later

Frame everything as “modifications” not “innovations”

Build insurance cost into every business case - it’ll double your payback

Find brokers who’ve seen plants, not just spreadsheets

For developers:

Partner with insurers early or watch projects die at FID

Document everything - insurers trust paper more than performance

Avoid the word “novel” - it adds 200% to premiums

For policymakers:

Insurance regulation is climate policy. Treat it as such

Force model transparency - black box underwriting is killing transition

Create backstops for proven-but-uninsurable technology

THE INSURANCE VETO MAP

Where innovation dies:

THE LEDGER LINE

The risk ceiling isn’t about risk. It’s about imagination.

Every underwriter betting against new technology while claiming to fear climate change. Every actuary using last century’s data to price next century’s problems. Every syndicate that finds fossil fuels safer than solutions.

The energy transition hasn’t hit technical limits or economic barriers.

It’s hit the absolute limit of what a room full of actuaries in London can imagine.

And that ceiling is exactly 40 years behind where we need to be.

But here’s what they don’t see coming: the first insurer to underwrite innovation, not replication, will own the century.

Thanks for reading, and please share The Ledger if you have found it useful or insightful in any way.

Here’s to what’s possible

Dom